M&a Science

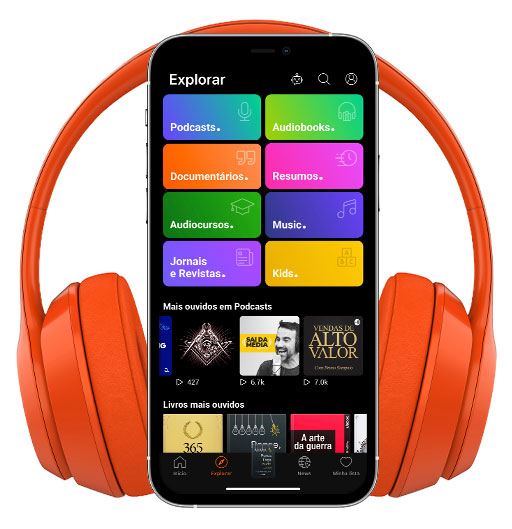

Fixing Broken Companies Through Smart Deals with Marc Bell Part 2

- Author: Vários

- Narrator: Vários

- Publisher: Podcast

- Duration: 0:30:11

- More information

Informações:

Synopsis

Marc Bell, CEO of Marc Bell Capital Marc Bell has taken 17 companies public, rebuilt distressed businesses, and invested across industries most wouldn’t dare touch. In this follow-up to Part 1, he’s back with sharp insights on what it really takes to run high-stakes deals—and survive them. Marc and Kison cover everything from building a rock-solid diligence process to choosing between private equity and private credit. They get tactical about capital allocation strategy, reflect on the mistakes that shaped Marc’s approach today, and unpack how to lead during downturns—when optimism fades and character shows. This episode is a masterclass in M&A realism. Whether you're planning your first minority recap or running a mature corp dev team, you'll walk away with fresh perspective—and a few war stories that’ll stick with you. Things you will learn: The tradeoffs between debt and equity—and when to choose either Why the wrong private equity partner can cost more than capital How to lead through setbacks a